| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to Section 240.14a-12 | |

| ☒ | No fee required. | |||

| ||||

| ||||

| ||||

| ||||

| ||||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | 14a-6(i)(1) and | |||

| ||||

| ||||

| ||||

0-11. | ||||

TRIUMPH BANCORP,FINANCIAL, INC.

12700 Park Central Drive, Suite 1700

Dallas, Texas 75251

(214) 365-6900

March 15, 202214, 2024

Dear Triumph Bancorp,Financial, Inc. Stockholders,

You are cordially invited to attend the Annual Meeting of Stockholders of Triumph Bancorp,Financial, Inc. (the “Company”). The meeting will be held on Tuesday, April 26, 2022.23, 2024. The Annual Meeting will begin promptly at 10:008:30 a.m., local time, at 3 Park Central, 12700 Park Central Drive, 15th Floor, Dallas, Texas 75251.

A Notice of Annual Meeting of Stockholders and the Proxy Statement for the meeting are attached. To ensure your representation at the Annual Meeting, you are urged to vote by proxy via the Internet or telephone pursuant to the instructions provided in the enclosed proxy card; or by completing, dating, signing and returning the enclosed proxy card.

Frederick Perpall, who has served on our Board since 2016, will not stand for re-election at the Annual Meeting. The Chairman and the entire board earnestly thank Mr. Perpall for his dedicated service to the Company. Following the Annual Meeting, the Board intends to fix the size of the Board at ten members.

The Notice of Annual Meeting and Proxy Statement on the following pages contain information about the official business of the Annual Meeting. Whether or not you expect to attend, please vote your shares now. Of course, if you decide to attend the Annual Meeting, you will have the opportunity to revoke your proxy and vote your shares in person. This Proxy Statement is also available at www.proxydocs.com/TBK.TFIN.

Sincerely,

Aaron P. Graft

President and Chief Executive Officer

Notice of Annual Meeting of Stockholders

To be held April 26, 202223, 2024

Meeting Information

| Date: | April | |

| Time: | ||

| Location: | 3 Park Central, 12700 Park Central Drive, 15th Floor Dallas, Texas 75251 | |

| Record Date: | Close of business, February |

Voting Items

| 1. | To elect the |

| 2. | To vote on a non-binding advisory resolution to approve the compensation of the Company’s named executive officers as disclosed in the accompanying proxy statement (the “Say on Pay Proposal”); |

| 3. | To |

|

To transact any business as may properly come before the Annual Meeting or any adjournments or postponements. |

We are furnishing our 20212023 Annual Report and proxy materials to our stockholders primarily through the Internet this year in accordance with rules adopted by the Securities and Exchange Commission. Stockholders of record have been mailed a Notice of Internet Availability of Proxy Materials on or around March 15, 2022,14, 2024, which provides them with instructions on how to vote and how to access the 20212023 Annual Report and proxy materials on the Internet. It also provides instructions on how to request paper copies of these materials.

Stockholders of record who previously enrolled in a program to receive electronic versions of the 20212023 Annual Report and proxy materials will receive an email notice with details on how to access those materials and how to vote.

| 2024 Proxy Statement |

Triumph Bancorp | 2022 Proxy Statement

How to Vote

Stockholders of record may vote:

| • |   | By Internet: go to www.proxypush.com/ | ||||

| • |   | By phone: call 866-206-5381 | ||||

| • |   | By mail: complete and return the enclosed proxy card in the postage prepaid envelope provided. | ||||

If your shares are held in the name of a broker, bank or other stockholder of record, please follow the voting instructions that you receive from the broker, bank or other stockholder of record entitled to vote your shares.

The Board of Directors has fixed the close of business on February 28, 202226, 2024 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting.

By Order of the Board of Directors,

| ||

| March |

| |

| Dallas, Texas | Aaron P. Graft | |

| President and Chief Executive Officer |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders

to be Held on April 26, 2022.23, 2024.

The Proxy Statement for the 20222024 Annual Meeting, the Notice of the 20222024 Annual Meeting, the form of proxy and the Company’s 20212023 Annual Report are available at www.proxydocs.com/TBK.TFIN.

| 2024 Proxy Statement |  | |

Triumph Bancorp | 2022 Proxy Statement

| 2024 Proxy Statement |

Triumph Bancorp | 2022 Proxy Statement

Proxy Summary

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all the information you should consider in voting your shares. Please read the complete proxy statement and our annual report carefully before voting.

Meeting Information |

Date: | April | |

Time: | ||

Location: | 3 Park Central, 12700 Park Central Drive, 15th Floor Dallas, Texas 75251 | |

Record Date: | Close of business, February |

How to Vote |

Your vote is important. You may vote your shares via the Internet, by telephone, by mail or in person at the Annual Stockholder Meeting. Please refer to the section “Information Concerning Solicitation and Voting” on page 1 for detailed voting instructions. If you vote via the Internet, by telephone or in person at the Annual Stockholder Meeting, you do not need to mail in a proxy card.

| INTERNET | TELEPHONE | IN PERSON | ||||

|

|

|

| |||

Visit will need the control number printed on your notice, proxy card or voting instruction form. | Dial toll-free (866-206-5381) or the telephone number on your voting instruction form. You will need the control number printed on your notice, proxy card or voting instruction form. | If you received a paper copy of the proxy materials, send your completed and signed proxy card or voting instruction form using the enclosed postage- paid envelope. | By attending the meeting and following the instructions for voting. | |||

Matters to be Voted Upon |

| Proposals | Proposals | Required Approval | Board Recommendation | Page Reference | Proposals | Required Approval | Board Recommendation | Page Reference | ||||||||

1. | Election of Directors | Majority of Votes Cast | FOR each Nominee | 5 | ||||||||||||

2. | Management Proposal Regarding Advisory Approval of the Company’s Executive Compensation | Majority of Votes Cast | FOR | 48 | ||||||||||||

1. | Election of Directors | Majority of Votes Cast | FOR each Nominee | 5 | ||||||||||||

2 | Management Proposal Regarding Advisory Approval of the Company’s Executive Compensation | Majority of Votes Cast | FOR | 57 | ||||||||||||

3. | Management Proposal to approve an amendment to the Company’s Second Amended and Restated Certificate of Formation to change the name of the Company from Triumph Bancorp, Inc. to Triumph Financial, Inc. | Two-Thirds of Outstanding Shares | FOR | 49 | ||||||||||||

4. | Ratification of Selection of Independent Registered Public Accounting Firm | Majority of Votes Cast | FOR | 50 | ||||||||||||

3. | Ratification of Selection of Independent Registered Public Accounting Firm | Majority of Votes Cast | FOR | 58 | ||||||||||||

| 2024 Proxy Statement |

Triumph Bancorp | 2022 Proxy Statement

TRIUMPH BANCORP,FINANCIAL, INC.

12700 Park Central Drive, Suite 1700

Dallas, Texas 75251

(214) 365-6900

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

APRIL 26, 2022April 23, 2024

INFORMATION CONCERNING SOLICITATION AND VOTING

Introduction

We are furnishing this Proxy Statement on behalf of the Board of Directors (the “Board of Directors”) of Triumph Bancorp,Financial, Inc. (“Triumph”), a Texas corporation, for use at our 20222024 Annual Meeting of Stockholders, or at any adjournments or postponements of the meeting (the “Annual Meeting”), for the purposes set forth below and in the accompanying Notice of Annual Meeting. The Annual Meeting will be held at 3 Park Central, 12700 Park Central Drive, 15th15th Floor, Dallas, Texas 75251, at 10:008:30 a.m. local time, on April 26, 2022.23, 2024.

In accordance with rules and regulations adopted by the Securities and Exchange Commission (“SEC”), instead of mailing a printed copy of our proxy materials to each stockholder of record, we are furnishing proxy materials to our stockholders on the Internet. You will not receive a printed copy of the proxy materials, unless specifically requested. The Notice of Internet Availability of Proxy Materials will instruct you as to how you may access and review all of the important information contained in the proxy materials. The Notice of Internet Availability of Proxy Materials also instructs you as to how you may submit your proxy on the Internet.

As used in this Proxy Statement, the terms “us”, “we”, “our”, the “Company” and “Triumph” refer to Triumph Bancorp,Financial, Inc., and, where appropriate, Triumph Bancorp,Financial, Inc., and its subsidiaries. The term “Common Stock” means shares of our Common Stock, par value, $0.01 per share.

Stockholders Entitled to Notice and to Vote; Quorum

Only holders of record of our Common Stock at the close of business on February 28, 2022,26, 2024, which the Board of Directors has set as the record date, are entitled to notice of, and to vote at, the Annual Meeting. As of February 28, 202226, 2024 we had 25,160,15623,334,997 shares of Common Stock outstanding and entitled to vote at the Annual Meeting, and our shares of Common Stock were held by approximately 349229 stockholders of record. Each stockholder of record of Common Stock on the record date will be entitled to one vote for each share held on all matters to be voted upon at the Annual Meeting. There are no cumulative voting rights in the election of directors.

The presence, in person or by proxy, of a majority of the votes entitled to be cast on a matter to be voted on at the Annual Meeting constitutes a quorum for action on that matter. The shares of Common Stock represented by properly executed proxy cards or properly authenticated voting instructions recorded electronically through the Internet or by telephone, will be counted for purposes of determining the presence of a quorum at the Annual Meeting. Abstentions and broker non-votes will be counted toward fulfillment of quorum requirements. A broker non-vote occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received instructions from the beneficial owner.

| 2024 Proxy Statement 1 |

Triumph Bancorp | 2022 Proxy Statement 1

Distinction Between Holding Shares as a Stockholder of Record and as a Beneficial Owner

Some of our stockholders hold their shares through a broker, trustee, or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those shares owned beneficially.

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, EQ Shareowner Services, then you are considered, with respect to those shares, the “stockholder of record.” As the stockholder of record, you have the right to grant your voting proxy directly to us or to a third party, or to vote in person at the Annual Meeting.

| • | Stockholder of Record. If your shares are registered directly in your name with our transfer agent, EQ Shareowner Services, then you are considered, with respect to those shares, the “stockholder of record.” As the stockholder of record, you have the right to grant your voting proxy directly to us or to a third party, or to vote in person at the Annual Meeting. |

Beneficial Owner. If your shares are held in a brokerage account, by a trustee or, by another nominee, then you are considered the “beneficial owner” of those shares. As the beneficial owner of those shares, you have the right to direct your broker, trustee, or nominee how to vote and you also are invited to attend the Annual Meeting. However, because a beneficial owner is not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a “legal proxy” from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the Annual Meeting.

| • | Beneficial Owner. If your shares are held in a brokerage account, by a trustee or, by another nominee, then you are considered the “beneficial owner” of those shares. As the beneficial owner of those shares, you have the right to direct your broker, trustee, or nominee how to vote and you also are invited to attend the Annual Meeting. However, because a beneficial owner is not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a “legal proxy” from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the Annual Meeting. |

If you are not a stockholder of record, please understand that we do not know that you are a stockholder, or how many shares you own.

Voting Deadline

If you are a stockholder of record on the record date, then your proxy must be received no later than 11:59 p.m., central time on April 25, 202222, 2024 to be counted. If you are the beneficial owner of your shares held through a broker, trustee, or other nominee, please follow the instructions of your broker, trustee, or other nominee in determining the deadline for submitting your proxy.

Voting without Attending the Annual Meeting

Whether you hold shares directly as a stockholder of record or through a broker, trustee, or other nominee, you may direct how your shares are voted without attending the Annual Meeting. You may give voting instructions by the Internet, by telephone, or by mail. Instructions are on the proxy card. The proxy holders will vote all properly executed proxies that are delivered in response to this solicitation, and not later revoked, in accordance with the instructions given by you.

Voting in Person

Shares held in your name as the stockholder of record on the record date may be voted in person at the Annual Meeting. Shares for which you are the beneficial owner but not the stockholder of record may be voted in person at the Annual Meeting only if you obtain a legal proxy from the broker, trustee, or other nominee that holds your shares giving you the right to vote the shares. Even if you plan to attend the Annual Meeting, we recommend that you vote by proxy as described below so that your vote will be counted if you later decide not to attend the Annual Meeting.

The vote you cast in person will supersede any previous votes that you may have submitted, whether by Internet, telephone, or mail.

Required Votes

At the Annual Meeting, stockholders will consider and act upon (1) the election of teneleven directors to our Board of Directors to serve until the next annual meeting of stockholders or until their respective successors

| 2 2024 Proxy Statement |  | |

have been elected and qualified, (2) the Say on Pay Proposal, (3) the Name Change Proposal, (4) the

2 Triumph Bancorp | 2022 Proxy Statement

ratification of the appointment of our independent registered public accounting firm, and (5)(4) such other business as may properly come before the Annual Meeting.

Election of Directors (Proposal 1). We have implemented majority voting in uncontested director elections. As a result, each director standing for election at the Annual Meeting will be elected by a majority of the votes cast by the outstanding shares present in person or by proxy and entitled to vote at the Annual Meeting, meaning that each director nominee must receive a greater number of such shares voted “for” such director than the number of such shares voted “against” such director. In a contested election, the director nominees receiving a plurality of the votes cast shall be elected directors.

| • | Election of Directors (Proposal 1). We have implemented majority voting in uncontested director elections. As a result, each director standing for election at the Annual Meeting will be elected by a majority of the votes cast by the outstanding shares present in person or by proxy and entitled to vote at the Annual Meeting, meaning that each director nominee must receive a greater number of such shares voted “for” such director than the number of such shares voted “against” such director. In a contested election, the director nominees receiving a plurality of the votes cast shall be elected directors. |

| • | All Other Proposals (Proposals 2 and 3). For all of the other proposals described in this Proxy Statement, the affirmative vote of a majority of the votes cast by the outstanding shares present in person or represented by proxy and entitled to vote at the Annual Meeting is required to approve each such proposal. |

Name Change Proposal (Proposal 3). Under our charter, the affirmative vote of holders of at least two-thirds of the outstanding shares entitled to vote on the Name Change Proposal is required to adopt the proposal. Abstentions, broker non-votes and failures to vote will have the same effect as votes against the Name Change Proposal.

All Other Proposals (Proposals 2 and 4). For all of the other proposals described in this Proxy Statement, the affirmative vote of a majority of the votes cast by the outstanding shares present in person or represented by proxy and entitled to vote at the Annual Meeting is required to approve each such proposal.

Abstentions and Broker Non-Votes

Under certain circumstances, including the election of directors, matters involving executive compensation and other matters considered non-routine, banks and brokers are prohibited from exercising discretionary authority for beneficial owners who have not provided voting instructions to the bank or broker. This is generally referred to as a “broker non-vote.” In these cases, as long as a routine matter is also being voted on, and in cases where the stockholder does not vote on such routine matter, those shares will be counted for the purpose of determining if a quorum is present, but will not be included as votes cast with respect to those matters. Whether a bank or broker has authority to vote its shares on uninstructed matters is determined by stock exchange rules. We expect that brokers will be allowed to exercise discretionary authority for beneficial owners who have not provided voting instructions only with respect to the proposal to ratify the selection of Crowe LLP as our independent registered public accounting firm but not with respect to any of the other proposals to be voted on at the Annual Meeting.

Abstentions and broker non-votes will not be treated as votes cast for any of the proposals at the Annual Meeting and will have no effect on the results of the Proposal for Election of Directors (Proposal 1), the Say on Pay Proposal (Proposal 2) and the Ratification of Crowe LLP as our Independent Registered Public Accounting Firm (Proposal 4), and will have the same effect as votes against the Name Change Proposal (Proposal 3).such proposals.

Treatment of Voting Instructions

If you provide specific voting instructions, your shares will be voted as instructed.

If you hold shares as the stockholder of record and sign and return a proxy card or vote by Internet or telephone without giving specific voting instructions, then your shares will be voted in accordance with the recommendations of our Board of Directors. Our Board of Directors recommends (1) a vote for the election of each of the director nominees to our Board of Directors, (2) a vote for approval, on a non-binding advisory basis, of the compensation of our named executive officers as disclosed in this Proxy Statement, (3) a vote for approval of the amendment to our Second Amended and Restated Certificate of Formation to change the name of the Company from Triumph Bancorp, Inc. to Triumph Financial, Inc., and (4)(3) a vote for the ratification of the appointment of Crowe LLP as our independent registered public accounting firm.

Triumph Bancorp | 2022 Proxy Statement 3

You may have granted to your broker, trustee, or other nominee discretionary voting authority over your account. Your broker, trustee, or other nominee may be able to vote your shares depending on the terms of the agreement you have with your broker, trustee, or other nominee.

The persons identified as having the authority to vote the proxies granted by the proxy card will also have discretionary authority to vote, in their discretion, to the extent permitted by applicable law, on such other business as may properly come before the Annual Meeting and any postponement or adjournment. The Board of Directors is not aware of any other matters that are likely to be brought before the Annual Meeting. If any other matter is properly presented for action at the Annual Meeting, including a proposal to

| 2024 Proxy Statement 3 |

adjourn or postpone the Annual Meeting to permit us to solicit additional proxies in favor of any proposal, the persons named in the proxy card will vote on such matter in their own discretion.

Revocability of Proxies

A stockholder of record who has been given a proxy may revoke it at any time prior to its exercise at the Annual Meeting by either (i) giving written notice of revocation to our Corporate Secretary, (ii) properly submitting a duly executed proxy bearing a later date, or (iii) appearing in person at the Annual Meeting and voting in person.

If you are the beneficial owner of shares held through a broker, trustee, or other nominee, you must follow the specific instructions provided to you by your broker, trustee, or other nominee to change or revoke any instructions you have already provided to your broker, trustee, or other nominee.

Costs of Proxy Solicitation

Proxies will be solicited from our stockholders by mail and through the Internet. We will pay all expenses in connection with the solicitation, including postage, printing and handling, and the expenses incurred by brokers, custodians, nominees and fiduciaries in forwarding proxy material to beneficial owners. It is possible that our directors, officers and other employees may make further solicitations personally or by telephone, facsimile or mail. Our directors, officers and other employees will receive no additional compensation for any such further solicitations.

| 4 2024 Proxy Statement |  | |

4 Triumph Bancorp | 2022 Proxy Statement

PROPOSAL 1: ELECTION OF DIRECTORS

Introduction

Upon the recommendation of the Nominating and Corporate Governance Committee, the Board of Directors has nominated each of the directors noted below (whom we refer to as the “nominees”) to stand for election for a one (1) year term expiring at the 20232025 annual meeting of stockholders or until their respective successors have been elected and qualified. Each director nominee must receive the affirmative vote of a majority of the votes cast to be elected (i.e., the number of shares voted “for” a director nominee must exceed the number of votes cast “against” that nominee). Unless contrary instructions are given, the shares represented by your proxy will be voted FOR the election of all director nominees.

Name | Position | |||

Carlos M. Sepulveda, Jr. | Director and Chairman of the Board | |||

Aaron P. Graft | Director, Vice Chairman and Chief Executive Officer | |||

Charles A. Anderson | Director | |||

Harrison B. Barnes | Director | |||

Debra A. Bradford | Director | |||

Richard L. Davis | Director | |||

Davis Deadman | Director | |||

Laura K. Easley | Director | |||

Maribess L. Miller | Director | |||

Michael P. Rafferty | Director | |||

C. Todd Sparks | Director | |||

Director Frederick Perpall will not stand for re-election at the Annual Meeting. The Chairman and the entire Board thank Mr. Perpall for his dedicated service to the Company. Upon the recommendation of the Nominating and Corporate Governance Committee, the Board of Directors has determined not to fill the seat that will be left vacant and fix the number of directors on the Board at ten (10) members.

All of the nominees listed above have consented to being named in this proxy statement and to serve if elected. However, if any nominee becomes unable to serve, proxy holders will have discretion and authority to vote for another nominee proposed by our Board. Alternatively, our Board may reduce the number of directors to be elected at the Annual Meeting.

| The Board of Directors unanimously recommends a vote FOR the |

Triumph Bancorp | 2022 Proxy Statement 5

| 2024 Proxy Statement 5 |

Information Concerning the Nominees and Directors

Biographical information for each director and nominee appears below. The information is based entirely upon information provided by the respective directors and nominees.

Director | Committee Membership | Director Since | Committee Membership | |||||||||||||||||||||||||||||||||||||||||||||||||||

Name | Age | Position | Independent | AC | CC | NC | RM | Age | Position | Independent | AC | CC | NCG | RCC | ||||||||||||||||||||||||||||||||||||||||

Charles A. Anderson | 61 | 2010 | Director | ✓ | C | ✓ | ||||||||||||||||||||||||||||||||||||||||||||||||

Harrison B. Barnes | 29 | 2021 | Director | ✓ | ✓ | |||||||||||||||||||||||||||||||||||||||||||||||||

Debra A. Bradford | 63 | 2020 | Director | ✓ | ✓ | ✓ | 65 | 2020 | Director | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||||||||||

Richard L. Davis | 68 | 2010 | Director | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||||||||||||||||||||||||

Davis Deadman | 60 | 2023 | Director | ✓ | ||||||||||||||||||||||||||||||||||||||||||||||||||

Laura K. Easley | 57 | 2020 | Director | ✓ | ✓ | C | 59 | 2020 | Director | ✓ | ✓ | C | ||||||||||||||||||||||||||||||||||||||||||

Aaron P. Graft | 44 | 2010 | Director, Vice Chairman, Chief Executive Officer & President | |||||||||||||||||||||||||||||||||||||||||||||||||||

Maribess L. Miller | 69 | 2014 | Director | ✓ | ✓ | C | ||||||||||||||||||||||||||||||||||||||||||||||||

Frederick P. Perpall* | 47 | 2016 | Director | ✓ | ✓ | |||||||||||||||||||||||||||||||||||||||||||||||||

Michael P. Rafferty | 67 | 2014 | Director | ✓ | C | ✓ | 69 | 2014 | Director | ✓ | C | ✓ | ||||||||||||||||||||||||||||||||||||||||||

Carlos M. Sepulveda, Jr. | 64 | 2010 | Director & Chairman | ✓ | ||||||||||||||||||||||||||||||||||||||||||||||||||

C. Todd Sparks | 54 | 2010 | Director | ✓ | ✓ | 56 | 2010 | Director | ✓ | ✓ | ||||||||||||||||||||||||||||||||||||||||||||

|

| C | Committee Chair |

| ✓ | Member |

| AC | Audit Committee |

| CC | Compensation Committee |

Nominating and Corporate Governance Committee |

Risk |

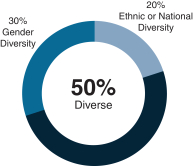

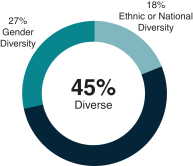

We believe the current composition of our Board of Directors provides a high level of independence and represents a broad mix of tenure, gender, ethnic, and cultural diversity with robust independence. Our Nominating and Corporate Governance Committee evaluates candidates for future directorships in light of these foregoing characteristics. In particular, the Board and the Nominating and Corporate Governance Committee believes it is appropriate to evaluate director diversity holistically by considering gender, ethnicity, as well as gendera range of other characteristics that inform diverse perspectives on our Board. Our Board does not manage to specific percentages or quotas for a particular type of diversity. In 2023, Davis Deadman was nominated and ethnic diversity.elected as director of the Company as part of the consolidation of the directorships of the Company and its subsidiary bank board. Director Deadman was nominated and elected to serve on the Company’s Board due to his prior experience with the Company as well as its subsidiary bank, and, in particular, due to his unique credit expertise and oversight thereto for the enterprise. Upon the election of Director Deadman in 2023, the Nominating and Corporate Governance Committee decided to not recommend any further changes to the composition of the Board (other than the election of Director Deadman and the corresponding increase in the size of the Board) as it believed the Board’s overall diversity (including the re-nomination of each incumbent director, which retained all existing diverse viewpoints on the Board notwithstanding any incremental reductions in percentage representation resulting from the increase in Board size) reflected then and continues to reflect now a commitment to diverse attributes and viewpoints on the Board. The Committee and the Board has determined such composition remains appropriate in 2024 and has noted that diversity will remain a key consideration when filling any future Board vacancy.

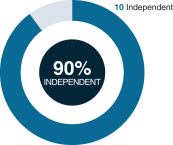

| Director Tenure | Diversity | Independence | ||

|   |   | ||

| 6 2024 Proxy Statement |

|  |

6 Triumph Bancorp | 2022 Proxy Statement

Director Qualifications and Attributes

We endeavor to have a Board that represents a broad range of qualities, skills and depth of experience in areas that are relevant to and contribute to the Board’s oversight of the Company’s activities. Among others, the Board has considered these key experiences, qualifications, skills and attributes in evaluating the composition of the Board and in considering nominees for new directors.

EXPERIENCE / QUALIFICATIONS / SKILLS / ATTRIBUTES | ||

Banking Experience | •We seek directors who have knowledge and experience in the banking industry, which is useful in understanding the operations, challenges and regulatory environment impacting our operations as a regulated financial institution. | |

Financial Experience | •As a public company, we are committed to strong financial discipline and accurate and transparent reporting and disclosure practices. We believe directors with public accounting backgrounds or senior financial leadership experience at other organizations are instrumental in providing oversight and guidance in these areas. | |

Senior Leadership Experience | •We believe it is important for our directors to have served in senior leadership roles in other organizations, including as senior executives, entrepreneurs and founders of businesses, which demonstrates a strong ability to motivate and manage others, to identify and develop leadership qualities in others and to manage organizations. | |

Diversity | •We value the representation of gender, ethnic, geographic, cultural and other perspectives that expand the Board’s understanding of the needs and viewpoints of our customers, team members, regulators and other stakeholders. | |

Public Company Board Experience | •Directors who have served on other public company boards can offer advice and perspective with respect to board dynamics and operations, relations between the board and executive management and other matters, including executive compensation, corporate governance and relations with stockholders. | |

Transportation and Payments Experience | •Given the large percentage of our business that touches the transportation industry, including our factoring, TriumphPay and equipment finance products, and TriumphPay’s emerging presence as a payments solution in the transportation sector, we believe directors with knowledge and experience in these industries provide useful perspective in understanding and providing guidance with respect to the trends, strategic challenges and opportunities in these sectors. | |

| 2024 Proxy Statement 7 |

Triumph Bancorp | 2022 Proxy Statement 7

The table below summarizes the key experience, qualifications and attributes for each member of our Board and highlights the balanced mix of experience, qualifications and attributes of the Board as a whole. This high-level summary is not intended to be an exhaustive list of each director’s skills or contributions to the Board.

Name | Banking Experience | Financial Experience | Senior Leadership Experience | Diversity | Public Company Board Experience | Transportation and Payments Experience | |||||||||||||||||||||||

Charles A. Anderson | X | X | |||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||

Harrison B. Barnes | X | X | |||||||||||||||||||||||||||

Debra A. Bradford | X |

| X |

| X |

| X |

| X | ||||||||||||||||||||

| |||||||||||||||||||||||||||||

Richard L. Davis | X | ||||||||||||||||||||||||||||

| X | X | X | ||||||||||||||||||||||||||

Laura K. Easley | X | X | X | ||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||

Aaron P. Graft | X | X |

| X | |||||||||||||||||||||||||

| |||||||||||||||||||||||||||||

Maribess L. Miller | X |

| X |

| X |

| X |

| |||||||||||||||||||||

Michael P. Rafferty | X | X | X | X |

| ||||||||||||||||||||||||

Carlos M. Sepulveda, Jr. | X |

| X |

| X |

| X |

| |||||||||||||||||||||

C. Todd Sparks | X | X | X | ||||||||||||||||||||||||||

|

As of March 15, 202214, 2024 we are in compliance with Nasdaq Rule 5605(f) regarding Board diversity and we will remain in compliance with such rule following our Annual Meeting giving effect to the directors standing for election at the meeting. The following diversity statistics are presented in accordance with the standardized disclosure matrix set forth in such Rule:

|

|

Total Number of Directors | 11 | |||||||||||||||||||||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||||||||||||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||||||||||||||||||

Part I: Gender Identity | ||||||||||||||||||||||||||||

Directors | 3 | 7 | — | — | 3 | 8 | — | — | ||||||||||||||||||||

Part II: Demographic Background | ||||||||||||||||||||||||||||

African American or Black | — | 1 | — | — | — | 1 | — | — | ||||||||||||||||||||

Alaskan Native or Native American | — | — | — | — | — | — | — | — | ||||||||||||||||||||

Asian | — | — | — | — | — | — | — | — | ||||||||||||||||||||

Hispanic or Latinx | — | 1 | — | — | — | 1 | — | — | ||||||||||||||||||||

Native Hawaiian or Pacific Islander | — | — | — | — | — | — | — | — | ||||||||||||||||||||

White | 3 | 5 | — | — | 3 | 6 | — | — | ||||||||||||||||||||

Two or More Races or Ethnicities | — | — | — | — | — | — | — | — | ||||||||||||||||||||

LGBTQ+ | — | — | — | — | — | — | — | — | ||||||||||||||||||||

Did Not Disclose Demographic Background | — | — | — | — | — | — | — | — | ||||||||||||||||||||

| 8 2024 Proxy Statement |

|  |

8 Triumph Bancorp | 2022 Proxy Statement

Directors Standing for Election at the 20222024 Annual Meeting

| Carlos M. Sepulveda, Jr.

Retired President and Chief Executive Officer Interstate Batteries, Inc.

Carlos M. Sepulveda, Jr. has served as Chairman of our Board of Directors since 2010. He also serves as | Chairman of the Board

Independent Director

Director Since 2010

Age Board Committees: • Compensation

Key Qualifications and Expertise: • Senior Leadership Experience • Financial Experience • Diversity

Other Current Public Boards: • Cinemark Holdings, Inc. | ||

| Directors of Savoya, a chauffeured ground transportation service provider. In 2007, he joined the Board of Directors of Cinemark Holdings, Inc. (NYSE: CNK) where he has been Lead Director since 2016 and | ||||

| Aaron P. Graft

Founder, Vice Chairman and Chief Executive Officer of the Company

Aaron P. Graft is the Founder, Vice Chairman and Chief Executive Officer of the Company. He also serves as the Vice Chairman and Chief Executive Officer of TBK Bank, SSB and is the | Director

Director Since 2010

Age

Key Qualifications and Expertise: • Banking Experience • Senior Leadership Experience • Transportation and Payments Experience | ||

| 2024 Proxy Statement 9 |

Triumph Bancorp | 2022 Proxy Statement 9

| Charles A. Anderson

Co-Founder Bandera Ventures, Ltd.

Charles A. Anderson cofounded Bandera Ventures, Ltd., a firm focused on industrial development and acquisitions, distressed office acquisitions and long-term lease opportunities. Prior to | Independent Director

Director Since 2010

Age

Board Committees: • Compensation (Chair) • Nominating Corporate Governance

Key Qualifications and Expertise: • Senior Leadership Experience

Other Current Public Boards: • Highwoods Properties, Inc.

| ||

| that, Mr. Anderson was associated with the Trammell Crow Company where he served as Senior Executive Director, responsible for the Development and Investment Group for the Western half of the United States. Since 2014, Mr. Anderson has served on the Board of Directors and as a member of the Investment Committee of Highwoods Properties, Inc. (NYSE:HIW), a publicly traded real estate investment trust. He earned his Bachelor of Business Administration and Master of Business Administration from Southern Methodist University, where he graduated summa cum laude. | ||||

| Harrison B. Barnes

Professional Athlete National Basketball Association

Harrison B. Barnes, through his family office, is a community bank supporter and investor. He | Independent Director

Director Since 2021

Age

Board Committees: • Compensation

Key Qualifications and Expertise: • Banking Experience • Diversity | ||

| subsidiary of Ames National Corporation (NASDAQ: ATLO). Mr. Barnes has been a professional athlete since 2012, representing the United States in the 2016 Olympics. He was voted to, and currently serves on the board of directors of USA Basketball, as Treasurer and Executive Committee member of the National Basketball Players Association, and as one of two inaugural Player Representatives on the board of directors of the NBA Foundation. Since 2012, Mr. Barnes has overseen all functions of his family’s business affairs, including analysis of representation and business proposals, venture capital transactions, and investments in publicly traded companies. Mr. Barnes’ community projects includes When We All Vote (Ambassador), Boys & Girls Club of Oakland (Board of Trustees), Learn Fresh (Champion and Advisor for NBA Math Hoops program), and Harrison Barnes Reading Academy (Founder, promoting literacy skills). | ||||

| Debra A. Bradford

President and Chief Financial Officer First American Payment Systems

Debra A. Bradford is President and Chief Financial Officer of First American Payment Systems, an industry leader and global solutions provider in merchant account services. Ms. Bradford joined First | Independent Director

Director Since 2020

Age

• Audit • Risk

Key Qualifications and Expertise: • Financial Experience • Senior Leadership Experience • Diversity • Transportation and Payments Experience

Other Current Public Boards: • Intermex International Money Express, Inc. | ||

| American Payment Systems by Deluxe in 2001 and has served as President and Chief Financial Officer since 2008. | ||||

| 10 2024 Proxy Statement |  | |

10 Triumph Bancorp | 2022 Proxy Statement

| Richard L. Davis

Retired Founder DAVACO, Inc.

Richard L. Davis is the Founder of Dallas-based DAVACO, Inc., a leading provider of retail, restaurant and hospitality service solutions. In 2000 and 2006, Mr. Davis was a finalist for the Ernst & | Independent Director

Director Since 2010

Age

Board Committees: • Compensation • Nominating Corporate Governance

Key Qualifications and Expertise: • Senior Leadership Experience | ||

| Young Entrepreneur of the Year | ||||

| Davis Deadman Retired Chief Executive Officer and President NexBank Capital, Inc. Davis Deadman has served on the board of the North Texas Certified Development Corporation, an SBA chartered entity focused on providing debt capital to the small business community in Texas. From | Director Since 2023 Age 60 Board Committees: • Risk and Compliance Key Qualifications and Expertise: • Banking Experience • Financial Experience • Senior Leadership Experience | ||

| 2004 to 2010, he served on multiple boards, including the bank and the holding company within the NexBank Capital, Inc. platform. From 2004 to 2010, Mr. Deadman served as Chief Executive Officer and President of NexBank, a financial services organization that included a broker-dealer and an investment banking and corporate advisory firm. From 1998 to 2009, Mr. Deadman served as a Senior Portfolio Manager and, ultimately, as a partner with Highland Capital Management L.P. In this role, he managed a team of investment professionals responsible for a several billion-dollar portfolio of credit investments. Before 1998, he served as an investment officer at Mutual Benefit Life, managing a $200 million commercial real estate-backed loan portfolio. Mr. Deadman served in various roles with the Company and TBK Bank, SSB from 2011-2022, including as TBK Bank’s Chief Lending Officer from 2011 to 2014. Such service in an employment capacity terminated in 2022. Mr. Deadman received a Bachelor of Business Administration from Texas A&M University and a Master of Business Administration in Finance, Cum Laude, from Southern Methodist University – Cox School of Business. He is a Chartered Financial Analyst (CFA) Charter holder. | ||||

| Laura K. Easley

Retired Chief Operating Officer Transportation Insight

Laura K. Easley was the Chief Operating Officer of Transportation Insight, a leading enterprise solutions provider in the logistics and transportation industry, from 2012 until her retirement in 2019. She | Independent Director

Director Since 2020

Age

• Nominating Corporate Governance • Risk

Key Qualifications and Expertise: • Senior Leadership Experience • Diversity • Transportation and Payments Experience | ||

| served in various other capacities at Transportation Insight from 2005 to 2019, including Chief Business Development Officer and Chief Solutions Officer. Prior to Transportation Insight, Ms. Easley served in various capacities with Menlo Worldwide, The Complete Logistics Company and ABF Freight Systems. Ms. Easley received a Bachelor of Science Degree in Industrial Engineering and Management from Oklahoma State University. She served on the Board of Directors for the OSU Cowboy Academy of Industrial Engineering and Management. | ||||

| 2024 Proxy Statement 11 |

| Maribess L. Miller

Retired Partner PricewaterhouseCoopers LLP

Maribess L. Miller was a member of the public accounting firm PricewaterhouseCoopers LLP from 1975 until 2009, including serving as the North Texas Market Managing Partner from 2001 | Independent Director

Director Since 2014

Age

Board Committees: • Nominating Corporate Governance (Chair) • Audit

Key Qualifications and Expertise: • Financial Experience • Senior Leadership Experience • Diversity

Other Current Public Boards: •

| ||

| until 2009; as Southwest Region Consumer, Industrial Products and Services Leader from 1998 until 2001; and as Managing Partner of the firm’s U.S. Healthcare Audit Practice from 1995-1998. Ms. Miller joined the board of DR Horton, Inc. (NYSE: DHI) in November, 2019 and serves as chair of the | ||||

Triumph Bancorp | 2022 Proxy Statement 11

| Michael P. Rafferty

Retired Partner, Ernst & Young LLP

Michael P. Rafferty was a member of the public accounting firm Ernst & Young LLP from 1975 until his retirement in 2013, was admitted as Partner of the Firm in 1988, and served as the Audit | Independent Director

Director Since 2014

Age

Board Committees: • Audit (Chair) • Risk

Key Qualifications and Expertise: • Financial Experience • Senior Leadership Experience

• | ||

| Practice Leader for the Southwest Region from 2004 to 2013. During his career with Ernst & Young, he primarily served clients in the financial services and healthcare industries. Mr. Rafferty graduated with a Bachelor of Science degree in Accounting from the University of New Orleans. Mr. Rafferty is a certified public accountant and is licensed in Texas. Mr. Rafferty also | ||||

| from March 2016 through October 2023. | ||||

| C. Todd Sparks

Vice President and Chief Financial Officer Discovery Operating Inc.

C. Todd Sparks | Independent Director

Director Since 2010

Age

Board Committees: • Audit

Key Qualifications and Expertise: • Banking Experience • Financial Experience • Senior Leadership Experience | ||

| Financial Officer of Discovery Operating Inc., an oil and gas exploration and production company located in Midland, Texas. He is also currently serving on the | ||||

Not Standing for Re-Election

| 12 2024 Proxy Statement |  | |||

| ||||

12 Triumph Bancorp | 2022 Proxy Statement

Information Regarding Executive Officers

Our executive officers are as follows:

Name | Age | Position | ||||||||||

Aaron P. Graft | Vice Chairman, Chief Executive Officer and President of the Company Vice Chairman, Chief Executive Officer of TBK Bank, SSB | |||||||||||

W. Bradley Voss | Executive Vice President and Chief Financial Officer of the Company and TBK Bank, SSB | |||||||||||

|

| |||||||||||

| Executive Vice President, | |||||||||||

Gail Lehmann | 66 | Executive Vice President, Chief Regulatory and Corporate Governance Officer, and Secretary of the Company and TBK Bank, SSB | ||||||||||

Todd Ritterbusch | President, TBK Bank, SSB | |||||||||||

Adam D. Nelson | 46 | Executive Vice President, | ||||||||||

Melissa Forman-Barenblit | 46 | Executive Vice President, TBK Bank, SSB, and President – TriumphPay | ||||||||||

A brief description of the background of each of our executive officers who is not also a director is set forth below.

W. Bradley Voss has served as our Executive Vice President, Chief Financial Officer since 2021. He also serves as Executive Vice President and Chief Financial Officer of TBK Bank, SSB. Mr. Voss joined the Company in a consulting engagement in 2011 and has served in various finance roles since joining the Company full-time in 2012. He was appointed as Chief Financial Officer in 2021. Prior to his current role, he led balance sheet strategy, capital issuance, investments, liquidity, and funding as the Company’s Senior Vice President and Treasurer from 2015 to 2019, and Executive Vice President and Treasurer from 2019 to 2021. Mr. Voss joined Triumph from CSG Investments (an affiliate of Beal Bank), where he led the sourcing, analysis and execution of investments in distressed securities as Senior Vice President and Portfolio Manager. Before joining CSG Investments, Mr. Voss served as a Portfolio Manager for Highland Capital Management, L.P. Earlier in his career, he worked in institutional equity sales and research at Donaldson, Lufkin & Jenrette and then Bear Stearns. Mr. Voss earned a Bachelor of Business Administration in accounting and finance from Texas Christian University and a Master of Business Administration from the University of Texas at Austin. He is a Chartered Financial Analyst (CFA) charter holder.

Ed Schreyer has served as Executive Vice President, Chief Operating Officer since 2022. He also serves as Executive Vice President and Chief Operating Officer of TBK Bank, SSB. Mr. Schreyer joined the Company in 2021 as President and Chief Operating Officer of TriumphPay. Mr. Schreyer joined the Company after 30 years of experience with CBRE Group, Inc. (NYSE: CBRE) where he was most recently Chief Operating Officer for the Americas Advisory business. During his years at CBRE, he led the Industrial and Logistics business serving top freight carriers and 3PL providers and he had executive oversight of the Security and Crisis Management Team. Mr. Schreyer holds a Bachelor of Science degree in Urban Studies/Affairs from Indiana University Bloomington.

Gail Lehmann has served as our Executive Vice President and Secretary since 2010. She also serves as Chief OperatingRegulatory and Governance Officer as well as Secretary of TBK Bank, SSB. Ms. Lehmann also served as the Chief Operating Officer of the Company and TBK Bank, SSB from 2010-2022. Previously, Ms. Lehmann served as Corporate Compliance Officer and Senior Vice President of Risk Management for

| 2024 Proxy Statement 13 |

Bluebonnet Savings Bank, FSB, a $3 billion wholesale thrift. Ms. Lehmann has been in the banking industry for more than 30 years and has experience in all facets of banking operations with particular emphasis on regulatory compliance, risk management, information technology and venture capital environments. She also has expertise in the area of property and subsidiary management. Ms. Lehmann received a Bachelor of Science, with a Major in Public Administration/Political Science and a Minor in Criminal Justice, from the University of Illinois.

Adam D. NelsonTodd Ritterbuschhas served as our Executive Vicethe President and General Counsel since 2013. He also serves as Executive Vice President and General Counsel of TBK Bank, SSB.SSB since 2022. Mr. Nelson previously served as Vice President and Chief Compliance Officer of Trinitas Capital Management, LLC, an independent registered investment adviser. In addition, Mr. Nelson previously served as Vice President and Deputy General Counsel of ACE Cash Express, Inc., a financial services retailer. Prior to that, Mr. Nelson was an attorney with the firm of Weil Gotshal & Manges, LLP, where he focused on mergers and acquisitions, management led buyouts and private equity transactions. Mr. Nelson received a Bachelor of Arts in Economics, magna cum laude, from Baylor University and a Juris Doctorate, cum laude, from Harvard Law School.

Triumph Bancorp | 2022 Proxy Statement 13

Todd Ritterbuschhas also served as the Executive Vice President and Chief Lending Officer of TBK Bank, SSB since May 2019.from 2019-2022. Prior to joining the Company, from 2002 to April of 2019, Mr. Ritterbusch served in various capacities with JPMorgan Chase Bank, including as the Managing Director, Market Executive for the Commercial Bank covering the Ft. Worth and West Texas markets. During his tenure with JPMorgan Chase Bank, Mr. Ritterbusch led a commercial banking team serving businesses with revenues between $20 million and $500 million across his market area. Mr. Ritterbusch holds a Bachelor of Science in Engineering from Purdue University and a Master of Business Administration from the Kellogg School of Management and a Master of Engineering Management from the McCormick School of Engineering at Northwestern University. He served on the boards of Cook Children’s Healthcare Foundation, Cook Children’s Health Plan and Leadership ISD.

Adam D. Nelson has served as our Executive Vice President, General Counsel and Assistant Secretary since 2013. He also serves as Executive Vice President, General Counsel and Assistant Secretary of TBK Bank, SSB. Mr. Nelson previously served as Vice President and Chief Compliance Officer of Trinitas Capital Management, LLC, a registered investment adviser. In addition, Mr. Nelson previously served as Vice President and Deputy General Counsel of ACE Cash Express, Inc., a financial services retailer. Prior to that, Mr. Nelson was an attorney with the firm of Weil Gotshal & Manges, LLP, where he focused on mergers and acquisitions, management led buyouts and private equity transactions. Mr. Nelson received a Bachelor of Arts in Economics, magna cum laude, from Baylor University and a Juris Doctorate, cum laude, from Harvard Law School.

14 Triumph Bancorp | 2022 Proxy Statement

| 14 2024 Proxy Statement |  | |

Board of Directors Meetings

During 2021,2023, the Board of Directors held five4 meetings and committees of the Board held a total of 21 meetings. Each of our directors attended at least 75% of the total meetings of the Board and committees on which he or she served during 2021.2023.

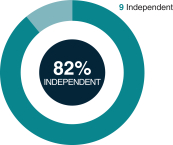

Director Independence

The Board of Directors has determined that with the exception of Aaron P. Graft and Davis Deadman, each of our current directors is an independent director as defined for purposes of the rules of the Securities and Exchange Commission (“SEC”) and the listing standards of The Nasdaq Stock Market (“NASDAQ”Nasdaq”). For a director to be considered independent, the Board must determine that the director does not have a relationship with the Company that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making this determination, the Board will consider all relevant facts and circumstances, including any transactions or relationships between the director and the Company or its subsidiaries.

Board Committees

Our Board of Directors has established standing committees in connection with the discharge of its responsibilities. These committees include the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee and the Risk Managementand Compliance Committee. Our Board of Directors also may establish such other committees as it deems appropriate, in accordance with applicable law and regulations and our corporate governance documents.

Audit Committee. Our Audit Committee is composed of Michael P. Rafferty (Chair), Maribess L. Miller, Debra A. Bradford and C. Todd Sparks. The Audit Committee assists the Board of Directors in fulfilling its responsibilities for general oversight of the integrity of our financial statements, compliance with legal and regulatory requirements, the independent auditors’ qualifications and independence, and the performance of our internal audit function and independent auditors. Among other things, the Audit Committee:

annually reviews the Audit Committee charter and the committee’s performance;

| • | annually reviews the Audit Committee charter and the committee’s performance; |

appoints, evaluates and determines the compensation of our independent auditors;

| • | appoints, evaluates and determines the compensation of our independent auditors; |

reviews and approves the scope of the annual audit, the audit fee and the financial statements;

| • | reviews and approves the scope of the annual audit, the audit fee and the financial statements; |

reviews disclosure controls and procedures, internal controls, internal audit function and corporate policies with respect to financial information;

| • | reviews disclosure controls and procedures, internal controls, internal audit function and corporate policies with respect to financial information; |

prepares the audit committee report to be included in our proxy statement or annual report filed with the SEC;

| • | discuss, review and approve the audit committee report to be included in our proxy statement or annual report filed with the SEC; |

oversees investigations into complaints concerning financial matters, if any; and

| • | oversees investigations into complaints concerning financial matters or violations of the Company’s Code of Business Conduct and Ethics, including any matters submitted through the Company’s whistleblower hotline, if any; |

| • | reviews other risks that may have a significant impact on our financial statements; and |

reviews other risks that may have a significant impact on our financial statements.

| • | conducts or authorizes investigations into any matters within the Committee’s scope of responsibility. |

The Audit Committee works closely with management as well as our independent auditors. The Audit Committee has the authority to obtain advice and assistance from and receive appropriate funding to engage outside legal, accounting or other advisors as the Audit Committee deems necessary to carry out its duties.

| 2024 Proxy Statement 15 |

The Audit Committee is composed solely of members who satisfy the applicable independence and other requirements of the SEC and the NASDAQNasdaq for Audit Committees and each of whom meet the additional criteria for independence of audit committee members set forth in Rule 10A-3(b)(1) under the Exchange Act. In addition, at least one member of the Audit Committee shall be a member of the Company’s Risk Managementand Compliance Committee. Each of Mr. Rafferty and Ms. Miller is an “audit committee

Triumph Bancorp | 2022 Proxy Statement 15

financial expert” as defined by the SEC. The Audit Committee has adopted a written charter that, among other things, specifies the scope of its rights and responsibilities. The charter is available on our website under the link entitled “Investor Relations – Corporate Governance” at www.triumphbancorp.comwww.tfin.com. Our Audit Committee met nine times during 2021.2023.

Compensation Committee. Our Compensation Committee is composed of, Charles A. Anderson (Chair), Harrison B. Barnes, Richard L. Davis, and Frederick P. Perpall. Following the Annual Meeting, our Compensation Committee will continue to have three members (Mr. Anderson (Chair), Mr. Barnes and Mr. Davis).Carlos M. Sepulveda, Jr. The Compensation Committee is responsible for discharging the Board of Directors’ responsibilities relating to compensation of our executives and team members.

Among other things, the Compensation Committee:

evaluates human resources and compensation strategies;

| • | evaluates human resources and compensation strategies; |

reviews and approves objectives relevant to executive officer compensation;

| • | reviews and approves objectives relevant to executive officer compensation; |

evaluates performance and determines the compensation of the Chief Executive Officer and our other executive officers in accordance with those objectives;

| • | evaluates performance and determines the compensation of the Chief Executive Officer and our other executive officers in accordance with those objectives; |

approves any changes to non-equity based benefit plans involving a material financial commitment;

| • | approves any changes to non-equity based benefit plans involving a material financial commitment; |

prepares the compensation committee report to be included in our annual report; and

| • | prepares the compensation committee report to be included in our annual report; and |

evaluates performance in relation to the Compensation Committee charter.

| • | evaluates performance in relation to the Compensation Committee charter. |

The Compensation Committee is composed solely of members who satisfy the applicable independence requirements of the SEC and the NASDAQ.Nasdaq. The Compensation Committee has adopted a written charter that, among other things, specifies the scope of its rights and responsibilities. The charter is available on our website under the link entitled “Investor Relations – Corporate Governance” at www.triumphbancorp.comwww.tfin.com. Our Compensation Committee met four times during 2021.2023.

Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee is composed of Maribess L. Miller (Chair), Charles A. Anderson, Laura K. Easley and Richard L. Davis. The Nominating and Corporate Governance Committee is responsible for making recommendations to our Board of Directors regarding candidates for directorships and the size and composition of our Board of Directors. In addition, the Nominating and Corporate Governance Committee is responsible for overseeing our corporate governance guidelines and reporting and making recommendations to our Board of Directors concerning governance matters.

Among other things, the Nominating and Corporate Governance Committee:

identifies individuals qualified to be directors consistent with the criteria approved by the Board of Directors and recommends director nominees to the full Board of Directors;

| • | identifies individuals qualified to be directors consistent with the criteria approved by the Board of Directors and recommends director nominees to the full Board of Directors; |

ensures that the Audit and Compensation Committees have the benefit of qualified “independent” directors;

| • | ensures that the Audit and Compensation Committees have the benefit of qualified “independent” directors; |

reviews and approves any related party transactions in accordance with our related party transaction policy;

| • | reviews and approves any related party transactions in accordance with our related party transaction policy; |

makes recommendations to the Board of Directors regarding the compensation of directors of the Company;

| • | makes recommendations to the Board of Directors regarding the compensation of directors of the Company; |

| 16 2024 Proxy Statement |  | |

oversees management continuity planning;

| • | provides oversight as to environmental, social and governance (“ESG”) matters impacting the Company and related reporting requirements; |

leads the Board of Directors in its annual performance review; and

| • | oversees management continuity planning; |

takes a leadership role in shaping the corporate governance of our organization.

| • | leads the Board of Directors in its annual performance review; and |

16 Triumph Bancorp | 2022 Proxy Statement

| • | takes a leadership role in shaping the corporate governance of our organization. |

The Nominating and Corporate Governance Committee is composed solely of members who satisfy the applicable independence requirements of the SEC and the NASDAQ. The written charter for our Nominating and Corporate Governance Committee is available on our website under the link entitled “Investor Relations – Corporate Governance” at www.triumphbancorp.comwww.tfin.com. Our Nominating and Corporate Governance Committee met four times during 2021.2023.

Risk Managementand Compliance Committee. Our Risk Managementand Compliance Committee is composed of Laura Easley (Chair), Debra A. Bradford, Davis Deadman, and Michael P. Rafferty. The Risk Management Committee is responsible for assisting the Board of Directors in the assessment of risk across the Company and its subsidiaries.

Among other things, the Risk Managementand Compliance Committee:

reviews and implements the Company’s enterprise risk assessment program as set forth in its enterprise risk management policy as in place from time to time as adopted by our Board of Directors;

| • | reviews and implements the Company’s enterprise risk assessment program as set forth in its enterprise risk management policy as adopted by our Board of Directors; |

reviews and recommends changes to the Company’s enterprise risk management policy to our Board of Directors;

| • | reviews and recommends changes to the Company’s enterprise risk management policy to our Board of Directors; |

provides oversight of the Company’s information technology infrastructure and security;

| • | provides oversight of the Company’s information technology infrastructure and security including cybersecurity; |

provides oversight of the Company’s regulatory compliance; and

| • | provides oversight of the Company’s regulatory compliance; and |

provides updates to our Board of Directors regarding its review of the risks facing the Company and its subsidiaries and its discussions with management on such risks and the steps being taken to mitigate such risks.

| • | provides updates to our Board of Directors regarding its review of the risks facing the Company and its subsidiaries and its discussions with management on such risks and the steps being taken to mitigate such risks. |

The Risk Managementand Compliance Committee is composed of a majority of members who satisfy the applicable independence requirements of the SEC and the NASDAQ.Nasdaq. In addition, at least one member of the Risk Managementand Compliance Committee shall be a member of the Company’s Audit Committee. The written charter for our Risk Managementand Compliance Committee is available on our website under the link entitled “Investor Relations – Corporate Governance” at www.triumphbancorp.comwww.tfin.com. Our Risk Management Committee met four times during 2021.2023.

Code of Business Conduct and Ethics and Code of Ethics for Senior Financial Officers

Our Board of Directors has adopted a code of business conduct and ethics (our “Code of Ethics”) that applies to all of our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer and persons performing similar functions. The Code of Ethics and supplemental code of ethics for CEO and senior financial officers is available upon written request to the Corporate Secretary, Triumph Bancorp,Financial, Inc., 12700 Park Central Drive, Suite 1700, Dallas, Texas 75251. If we amend or grant any waiver of a provision of our Code of Ethics that applies to our executive officers, we will publicly disclose such amendment or waiver on our website and as required by applicable law, including by filing a Current Report on Form 8-K.

Board Leadership Structure and Risk Oversight

Different individuals serve as our Chief Executive Officer and Chairman because our Board of Directors has determined that the separation of these offices enhances our Board of Directors’ independence and

| 2024 Proxy Statement 17 |

oversight. Moreover, the separation of these roles allows our Chief Executive Officer to better focus on his growing responsibilities of running the Company, enhancing stockholder value and expanding and strengthening the Company’s franchise while allowing the Chairman to lead our Board of Directors in its fundamental role of providing advice to and independent oversight of management. Consistent with this determination, Carlos M. Sepulveda, Jr., serves as Chairman of our Board of Directors, and Aaron P. Graft serves as our Chief Executive Officer and President.

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. We face a number of risks, including credit, interest rate, liquidity, operational, strategic and

Triumph Bancorp | 2022 Proxy Statement 17

reputation risks. Management is responsible for the day-to-day management of risks the Company faces, while the Board of Directors, as a whole and through its committees, including its Risk Managementand Compliance Committee, has responsibility for the oversight of risk management. In its risk oversight role, the Board of Directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed. The Chairman of the Board of Directors and independent members of the Board of Directors work together to provide strong, independent oversight of the Company’s management and affairs through its standing committees and, when necessary, special meetings of independent directors.

Compensation Committee Interlocks and Insider Participation

No members of our Compensation Committee are or have been an officer or employee of Triumph or any of our subsidiaries. In addition, nonesubsidiaries with the exception of our Chairman, Carlos M. Sepulveda, Jr. who previously served as Executive Chairman of the Company (service in such role ending in 2015) and who has subsequently been determined by our Board to be an independent director under the rules of the SEC and listing standards of Nasdaq. None of our executive officers serves or has served as a member of the Board of Directors, Compensation Committee or other board committee performing equivalent functions of any entity that has one or more executive officers serving as one of our directors or on our Compensation Committee.

Nomination of Directors

With respect to directors not nominated by Triumph, the Board of Directors identifies nominees by first evaluating the current members of the Board of Directors willing to continue in service. Current members of the Board of Directors with skills and experience that are relevant to our business and who are willing to continue in service are considered for re-nomination. If any member of the Board of Directors does not wish to continue in service or if the Board of Directors decides not to re-nominate a member for re-election, the Board of Directors then identifies the desired skills and experience of a new nominee in light of the criteria below. Current members of the Board of Directors are polled for suggestions as to individuals meeting the criteria below. The Board of Directors may also engage in research to identify qualified individuals. In evaluating a director nominee, the Board of Directors considers the following factors:

the appropriate size of our Board of Directors;

| • | the appropriate size of our Board of Directors; |

our needs with respect to the particular talents and experience of our directors;

| • | our needs with respect to the particular talents and experience of our directors; |

the nominee’s knowledge, skills and experience, including experience in finance, administration or public service, in light of prevailing business conditions and the knowledge, skills and experience already possessed by other members of the Board of Directors;

| • | the nominee’s knowledge, skills and experience, including experience in finance, administration or public service, in light of prevailing business conditions and the knowledge, skills and experience already possessed by other members of the Board of Directors; |

whether the nominee is independent, as that term is defined under the NASDAQ listing standards;

| • | whether the nominee is independent, as that term is defined under the Nasdaq listing standards; |

the familiarity of the nominee with our industry;

| • | the familiarity of the nominee with our industry; |

the nominee’s experience with accounting rules and practices; and

| • | the nominee’s experience with accounting rules and practices; and |

| • | the desire to balance the benefit of continuity with the periodic injection of the fresh perspective provided by new Board of Directors members. |

| 18 2024 Proxy Statement |  | |

the desire to balance the benefit of continuity with the periodic injection of the fresh perspective provided by new Board of Directors members.

Our goal is to assemble a Board of Directors that brings together a variety of perspectives and skills derived from high quality business and professional experience. In doing so, the Board of Directors will also consider candidates with appropriate non-business backgrounds.

Other than the foregoing, there are no stated minimum criteria for director nominees. The Board of Directors may also consider such other factors as it may deem in our best interests and the best interests of our stockholders. We also believe it may be appropriate for key members of our management to participate as members of the Board of Directors.

Stockholders may nominate directors for election to the Board of Directors. In order to nominate a director for election to the Board of Directors, stockholders must follow the procedures set forth in our

18 Triumph Bancorp | 2022 Proxy Statement

Bylaws, including timely receipt by the Secretary of Triumph of notice of the nomination and certain required disclosures with respect both to the nominating stockholder and the recommended director nominee.

Directors may currently be elected by a majority of votes cast (in uncontested elections) or a plurality of votes (in contested elections) at any meeting called for the election of directors at which a quorum is present. The presence of a majority of the holders of our Common Stock, whether in person or by proxy, constitutes a quorum. The Board of Directors did not receive any recommendations from stockholders requesting that the Board of Directors consider a candidate for inclusion among the nominees in our Proxy Statement for this Annual Meeting. The absence of such a recommendation does not mean, however, that a recommendation would not have been considered had one been received.

Stockholder Communications with the Board of Directors

Every effort is made to ensure that the Board of Directors or individual directors, as applicable, hear the views of stockholders and that appropriate responses are provided to stockholders in a timely manner. Any matter intended for the Board of Directors, or for any individual member or members of the Board of Directors, should be directed to Adam D. Nelson, our General Counsel, with a request to forward the matter to the intended recipient. All such communications will be forwarded unopened.

Director Attendance at Annual Meeting of Stockholders

We encourage all incumbent directors, as well as all nominees for election as director, to attend the Annual Meeting of Stockholders, although we recognize that conflicts may occasionally arise that will prevent a director from attending an annual meeting. EachTen of our teneleven then serving directors virtually attended our 20212023 annual meeting.

Hedging Policy and Pledging Restrictions

We do not permit our directors or executive officers to engage in transactions that hedge such director’s or executive officer’s economic risk of owning shares of our common stock.Common Stock. Thus, our directors and executive officers may not engage in hedging transactions in the Company’s shares such as puts, calls, prepaid variable forwards, equity swaps, collars and other derivative securities on an exchange or in any other organized market. Our directors and executive officers also may not engage in short sales of the Company’s shares, meaning sales of shares that are not owned at the time of sale. In addition, the Company does not permit shares pledged by senior executive officers and directors to be applied toward stock ownership guidelines, and limits pledging to pre-approved exceptions where the executive officer or director can clearly demonstrate the financial ability to repay the loan without resorting to the pledged securities.

| 2024 Proxy Statement 19 |

Triumph Bancorp | 2022 Proxy Statement 19

COMPENSATION DISCUSSION AND ANALYSIS

In this section we discuss and analyze the compensation of our “namednamed executive officers”officers (“NEOs”) including our Chief Executive Officer, the Chief Financial Officer and the next three most highly compensated executive officers. This discussion and analysis also includes a description of our compensation practices and philosophy, our decision making process for compensation matters, and the material factors impacting our compensation decisions for 20212023 compensation.

Executive Summary

20212023 Financial Performance

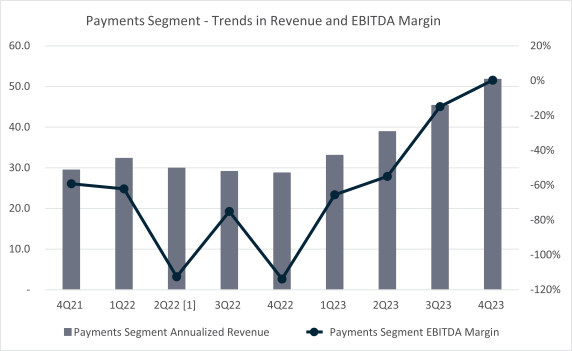

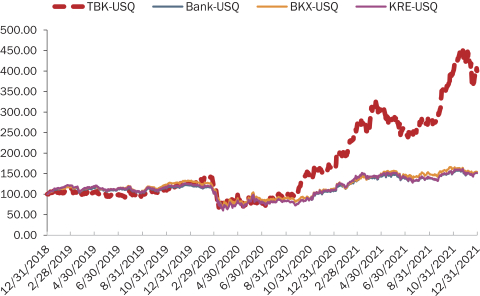

During 2021,2023, the Company made significant advancements on key strategic initiatives while successfully navigating significant stress and uncertainty in the banking sector, a protracted recession in the transportation and freight industry, and an elevated interest rate environment that continued to put pressure on the Company’s clients and borrowers. These trends, which began in 2022 and continued throughout 2023, significantly impacted all of the economic sectors in which the Company operates, including banking, transportation, technology and payments. Notwithstanding these challenges, in particular the impact of the freight recession on near term earnings, the Company’s underlying business and long-term prospects continued to thrive, including significant achievements and high performance with respect to key operational and segment-level metrics during the year.

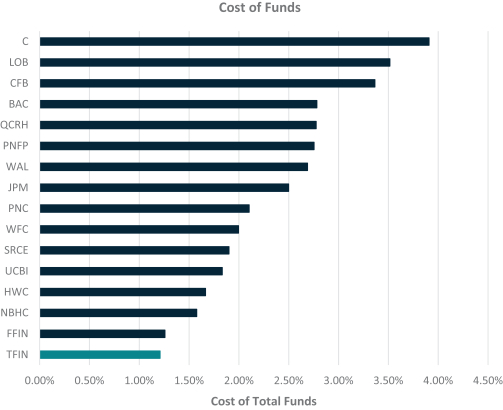

As a result of the headwinds discussed above, the Company determined during the course of 2023 to focus on: (i) moderating expense growth, (ii) controlling core deposit attrition in its banking franchise while maintaining a low overall cost of funds, (iii) continuing to organically grow and expand both transactional volumes and revenues at TriumphPay, and (iv) driving operational improvements in its factoring segment, positioning this business to take advantage of the eventual rebound in this market. The Company earned net income to common stockholders for 2023 of $37.9 million, or $1.61 per share, with the conditions outlined above placing pressure on near term earnings. However, as a result of successful execution of the initiatives above, the Company delivered recordkey financial performance while simultaneously pivoting the growth strategy forand strategic achievements across its TriumphPay payments platform, transitioning the Company’s focus tobusiness lines.

Banking

The banking segment successfully controlled deposit attrition and maintained a develop a fee driven payments network for the for-hire trucking ecosystemtop tier overall cost of funds in the United States, connecting third party logistics companies, or 3PLs (“Brokers”), the manufacturers and other businesses that contract directly for the shipment of goods (“Shippers”), the trucking companies that haul freight for such Brokers and Shippers (“Carriers”), and the factoring companies that provide working capital to Carriers (“Factors”).